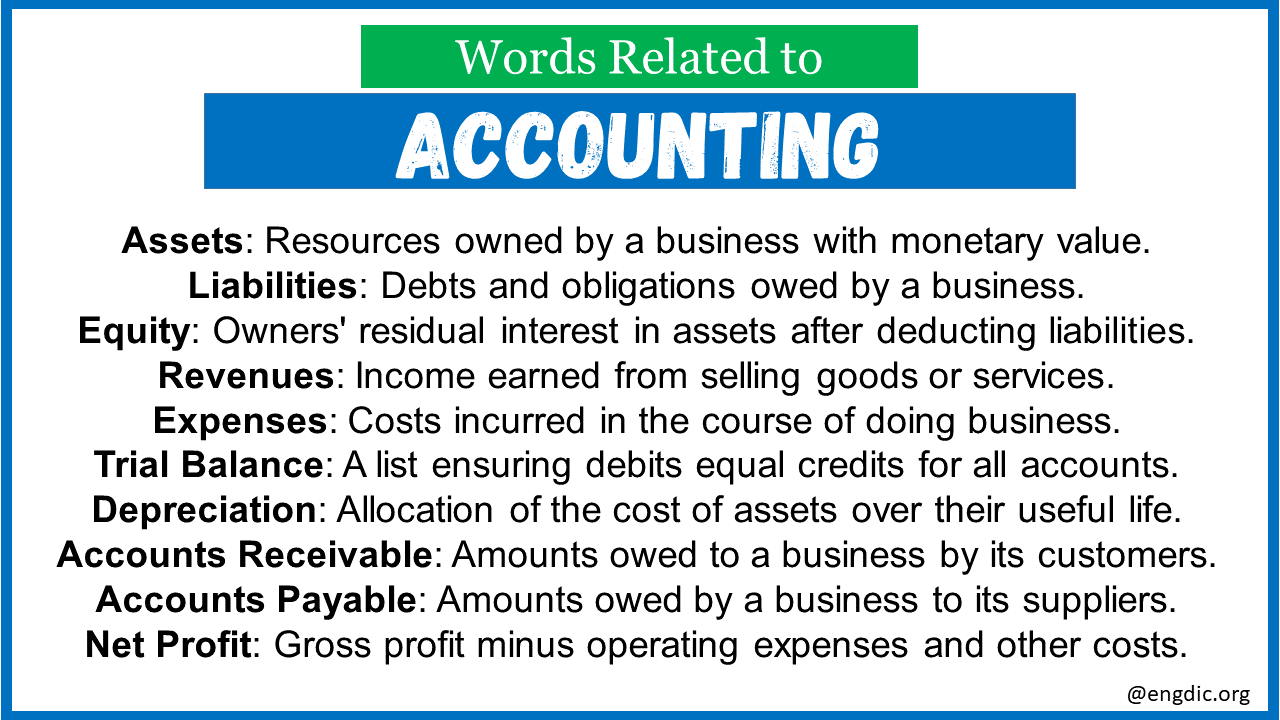

Accounting, often dubbed the “language of business”, involves the recording, analyzing, and reporting of financial transactions. Familiarity with key accounting terms can greatly enhance one’s understanding of financial statements and business operations. Here are the top 30 words related to accounting and their concise definitions.

Words Related to Accounting:

- Assets: Resources owned by a business with monetary value.

- Liabilities: Debts and obligations owed by a business.

- Equity: Owners’ residual interest in assets after deducting liabilities.

- Revenues: Income earned from selling goods or services.

- Expenses: Costs incurred in the course of doing business.

- Balance Sheet: A financial statement showing assets, liabilities, and equity.

- Income Statement: Report detailing revenues, expenses, and resulting profit or loss.

- Debit: An accounting entry increasing assets or expenses, or decreasing equity or liability.

- Credit: An accounting entry increasing equity or liabilities, or decreasing assets or expenses.

- General Ledger: A complete record of all financial transactions over a company’s life.

- Journal: Initial recording of financial transactions in chronological order.

- Trial Balance: A list ensuring debits equal credits for all accounts.

- Accrual: Recognizing revenue or expense before cash changes hands.

- Cash Flow: The total amount of money transferred into and out of a business.

- Depreciation: Allocation of the cost of assets over their useful life.

- Accounts Receivable: Amounts owed to a business by its customers.

- Accounts Payable: Amounts owed by a business to its suppliers.

- Double Entry: Accounting system where every transaction affects at least two accounts.

- Bookkeeping: The recording of financial transactions on a day-to-day basis.

- Retained Earnings: Profits not distributed as dividends, kept for future investment.

- Financial Statements: Reports summarizing financial activities (e.g., balance sheet, income statement).

- Taxation: Amounts due to the government based on income, profit, or other criteria.

- Auditing: Examination and verification of financial statements and records.

- Cost of Goods Sold (COGS): Direct costs attributable to production of goods sold.

- Gross Profit: Revenues minus the cost of goods sold.

- Net Profit: Gross profit minus operating expenses and other costs.

- Accounting Period: Time frame for which financial statements are prepared.

- Capital: Financial resources available for use in a business.

- Budget: A financial plan outlining income and expenses for a set period.

- Inventory: Goods available for sale or raw materials to produce goods.

Read Other Related Words: