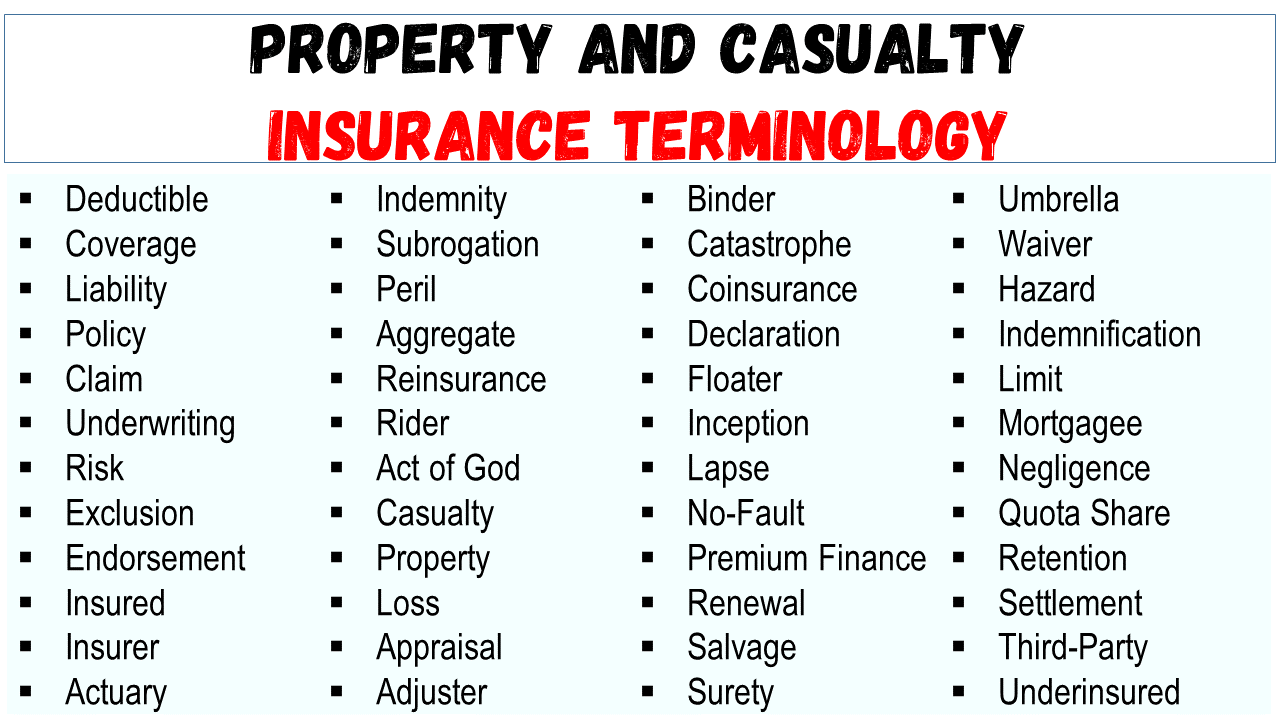

In the complex landscape of property and casualty insurance, the terminology can often be as intricate as the policies themselves. This blog post is not just a gateway for industry professionals and policyholders to comprehend the finer details of their insurance coverage but also serves as an invaluable resource for language learners delving into the specialized lexicon of insurance.

Our goal is to unravel the often perplexing jargon, offering clarity and insight into key insurance terms. For language learners, this journey is about more than grasping policy specifics; it’s an opportunity to expand vocabulary, understand contextual usage, and gain a foothold in the specialized language of insurance.

Recognizing the diverse needs of our audience, we have also prepared a comprehensive, easy-to-follow PDF guide. This resource is available for free download and is meticulously designed to support both insurance understanding and language development.

Let’s embark on this dual path of insurance education and language mastery, equipped with the right tools and resources.

Related:

Download Property and Casualty Insurance Terminology in PDF, Here.

Property and Casualty Insurance Terminology

A

- Accidental Death and Dismemberment (AD&D) Insurance: Covers death or injury from accidents.

- Act of God: Natural events outside human control.

- Actual Cash Value (ACV): Property’s value minus depreciation.

- Additional Insured: Others covered under a policy.

- Additional Insured by Endorsement: Additional parties added to policy.

- Additional Living Expenses (ALE): Extra costs during home unavailability.

- Additional Named Insured: Other insured entities on policy.

- Additional Premium: Extra charge for added coverage.

- Adjuster: Evaluates insurance claims professionally.

- Adverse Selection: High-risk individuals seeking more insurance.

- Agent of Record: Authorized insurance representative.

- Aggregate Deductible: Total deductible over a period.

- Aggregate Excess of Loss Reinsurance: Reinsurance for aggregate claim amounts.

- Aggregate Limit: Maximum payout in policy term.

- Aggregate Limit of Liability: Total liability cap in insurance.

- Aggregate Policy Limit: Cap on insurance policy payments.

- Agreed Value Coverage: Insurance based on agreed property value.

B

- Bailee’s Customer Insurance: Covers clients’ property with bailee.

- Binder: Temporary insurance agreement.

- Binder Letter: Written temporary insurance coverage confirmation.

- Bodily Injury Liability: Covers injury to others.

- Building Ordinance Coverage: Covers building code upgrade costs.

- Business Interruption Insurance: Compensates for business income loss.

- Business Owners Policy (BOP): Combined property and liability insurance.

C

- Cancellation Clause: Terms for policy termination.

- Captive Insurance Company: Subsidiary insurer for parent company.

- Casualty Insurance: Covers loss from accidents/liabilities.

- Catastrophe Bond: Risk-linked securities for catastrophe coverage.

- Catastrophic Event: Large-scale disaster causing significant loss.

- Ceding Company: Insurer transferring risk to reinsurer.

- Certificate of Insurance: Proof of insurance document.

- Claim: Request for insurance payment.

- Claim Adjuster: Assesses insurance claim validity.

- Coinsurance Clause: Shared risk between insurer and insured.

- Co-Insurance Clause: Same as Coinsurance Clause.

- Coinsurance Penalty: Penalty for underinsuring property.

- Collateral Source: Alternative compensation source for loss.

- Collateral Source Rule: Limits claimant compensation for injury.

- Collision Coverage: Covers vehicle damage from collisions.

- Combined Ratio: Measure of insurance company profitability.

- Comprehensive Coverage: Insurance for non-collision vehicle damage.

- Concurrency Clause: Aligns coverage terms in multiple policies.

- Contingent Liability: Liability depending on future events.

- Coverage: Protection extent by insurance policy.

- Credit Insurance: Insures against customer non-payment.

- Cross-Purchase Agreement: Agreement among shareholders for buy-sell.

D

- Data Breach Insurance: Protects against data security breaches.

- Debris Removal Coverage: Covers cleanup after covered event.

- Declarations: Policy details page.

- Declarations Page: Document listing insurance policy details.

- Declination: Refusal to insure.

- Deductible: Amount paid before insurance coverage.

- Deductible Carryforward: Deductible amount carried to next period.

- Deductible Carryover: Same as Deductible Carryforward.

- Deductible Waiver: Clause eliminating deductible in certain cases.

- Depreciation: Reduction in item’s value over time.

- Dividend: Insurer’s return of premium portion.

- Drive-Other-Car Endorsement: Extends auto coverage to certain individuals.

- Dwelling: Residence covered by insurance.

E

- Employment Practices Liability Insurance (EPLI): Covers wrongful employment practices claims.

- Endorsement: Policy modification or addition.

- Enhanced Coverage: Additional coverage beyond standard policy.

- Errors and Omissions (E&O) Insurance: Protects against professional errors/mistakes.

- Excess and Surplus Lines Insurance: For high-risk, unconventional insurance needs.

- Excess Insurance: Additional coverage beyond primary policy.

- Exclusion: Specific risks not covered.

- Exclusion Clause: Policy terms excluding certain coverages.

- Face Amount: Value of insurance policy.

F-G-H

- Facultative Certificate: Document for facultative reinsurance agreement.

- Facultative Reinsurance: Single risk reinsurance.

- Fair Access to Insurance Requirements (FAIR) Plan: Insurance for high-risk properties.

- Fire Insurance: Covers loss/damage from fire.

- First-Party Claim: Claim by insured against their policy.

- Floater: Additional coverage for specific items.

- Flood Insurance Rate Map (FIRM): Maps used in flood insurance.

- Force Majeure: Unforeseeable events preventing contract fulfillment.

- Force-Placed Insurance: Imposed by lender for uninsured property.

- Grace Period: Timeframe for overdue premium payment.

- Gross Negligence: Severe carelessness or reckless behavior.

- Guaranty Fund: Protects policyholders from insurer bankruptcy.

- Hard Market: High demand, high premium market.

- Hazard: Condition increasing risk or danger.

- Hazard Insurance: Covers physical property damage.

- Hazardous Activity Insurance: Covers activities with higher risk levels.

- Hazardous Materials Coverage: Insurance for hazardous materials incidents.

- Hired and Non-Owned Auto Coverage: Covers business-used, non-owned vehicles.

- Host Liquor Liability: Liability for serving alcohol at events.

I

- Impaired Insurer: Financially unstable insurance company.

- Inception Date: Start date of insurance coverage.

- Incurred But Not Reported (IBNR): Claims occurred, not yet reported.

- Incurred But Not Reported (IBNR) Reserves: Reserves for IBNR claims.

- Indemnification: Compensation for loss or damage.

- Indemnity: Security against loss or damage.

- Indemnity Bond: Guarantees compensation for loss/damage.

- Indemnity Clause: Contractual agreement to cover losses.

- Indirect Loss: Secondary financial loss from insured event.

- Insurable Interest: Financial stake in insured item.

- Insurance Pool: Collective risk-sharing by insurers.

- Insured: Entity protected by insurance policy.

- Insurer: Company providing insurance coverage.

J

- Jewelers Block Insurance: Insurance for jewelers’ inventory and equipment.

- Joint and Several Liability: Multiple parties liable for entire damage.

- Joint Underwriting Association (JUA): Pool of insurers sharing risk.

K

- Key Person Insurance: Coverage for vital business individuals.

L

- Lapse: Policy termination due to non-payment.

- Liability Insurance: Protects against legal liability costs.

- Lienholder: Entity with financial claim on property.

- Liquidity Risk: Risk of insufficient funds availability.

- Liquor Liability Insurance: Covers alcohol-related liability claims.

M-N

- Malpractice Insurance: Covers professionals against negligence claims.

- Manuscript Endorsement: Custom insurance policy amendment.

- Manuscript Insurance: Customized insurance policy.

- Manuscript Policy: Tailored policy for specific needs.

- Monoline Policy: Insurance covering a single risk.

- Mortgage Insurance Premium (MIP): Premium for mortgage insurance.

- Mortgagee Clause: Protects mortgagee’s interest in property.

- Named Driver Policy: Auto insurance for specified drivers.

- Named Insured: Main insured entity on policy.

- Named Perils: Specific risks covered in policy.

- Named Storm: Designated storm for insurance purposes.

- No-Fault Insurance: Covers own damages, regardless of fault.

- Non-Admitted Insurer: Not licensed in given jurisdiction.

- Non-Cancellable Policy: Cannot be canceled by insurer.

- Non-Renewal: Not renewing an insurance policy.

O

- Occurrence: Event causing insurance claim.

- Occurrence Policy: Covers claims from policy period events.

- Occurrence Reporting Form: Document for reporting occurrences.

- Occurrence-Based Coverage: Insurance for incidents during policy period.

- Ocean Marine Insurance: Covers sea transport risks.

- Open Perils: Covers all risks unless excluded.

- Open Policy: Flexible, ongoing insurance coverage.

- Overinsurance: Excessive insurance coverage.

P

- Payroll Deduction Plan: Premium payment via payroll deduction.

- Per Occurrence Deductible: Deductible for each separate incident.

- Per Occurrence Limit: Maximum payout per incident.

- Peril: Specific risk or cause of loss.

- Peril Insurance: Covers specific perils.

- Period of Restoration: Time for business recovery post-loss.

- Personal Articles Floater: Insurance for valuable personal items.

- Personal Umbrella Policy (PUP): Extra liability coverage.

- Policy: Contract between insurer and insured.

- Policy Endorsement: Change to insurance policy.

- Policyholder: Person owning the insurance policy.

- Policyholder Surplus: Insurer’s financial cushion.

- Policyholder’s Duties: Responsibilities of the insured.

- Premium: Payment for insurance coverage.

- Premium Credit: Discount on insurance premium.

- Premium Financing: Loan for paying insurance premiums.

- Premium Rate: Cost of insurance per unit coverage.

Q

- Quota Share Reinsurance: Shared risk and premiums with reinsurer.

- Quota Share Treaty: Agreement dividing risk among insurers.

- Quotation: Estimated insurance policy cost.

- Quote: Same as Quotation.

R

- Rate Class: Risk category for insurance premiums.

- Reinstatement: Restoring lapsed insurance policy.

- Reinsurance: Transferring risk from one insurer to another.

- Reinsurance Pool: Collective risk-sharing by reinsurers.

- Reinsurance Treaty: Agreement between primary insurer and reinsurer.

- Replacement Cost: Cost to replace property new.

- Replacement Cost Value (RCV): Full cost to replace damaged property.

- Rescission: Canceling insurance policy retroactively.

- Retrocession: Reinsurer passing risk to another reinsurer.

- Risk: Potential for loss or damage.

- Risk Assessment: Evaluating potential risks.

- Risk Management: Identifying and mitigating risks.

S

- Salvage: Recovered property after a loss.

- Salvage Value: Estimated value of salvaged property.

- Self-Insured: Retaining own risk instead of insuring.

- Self-Insured Retention (SIR): Amount paid by self-insured entity.

- Special Hazard Insurance: Coverage for specific high-risk situations.

- Special Risk Insurance: Insurance for unusual or high risks.

- Stop-Loss Insurance: Protects against high claims.

- Sublimit: Limit within overall policy limit.

- Sublimit Endorsement: Amendment specifying sublimit in policy.

- Subrogation: Insurer’s right to pursue third-party recoveries.

- Subrogation Clause: Terms for insurer’s recovery rights.

- Surety Bond: Guarantees performance or payment.

- Surplus Line Broker: Brokers non-standard insurance policies.

- Surplus Lines Insurance: Insurance for risks not covered by traditional insurers.

T

- Temporary Living Expenses: Covers living costs during home repair.

- Tenants Insurance: Insurance for renters.

- Third-Party Administrator (TPA): Manages insurance claims and administration.

- Third-Party Claim: Claim against another’s insurance policy.

- Third-Party Liability Insurance: Covers liability to others.

- Title Defect: Issue with property title.

- Title Insurance: Insurance against title defects.

- Total Loss: Damage exceeding property’s value.

- Umbrella Insurance: Additional liability coverage.

- Umbrella Liability Insurance: Extra liability protection.

- Umbrella Liability Policy: Broad liability coverage beyond standard limits.

U

- Underinsured Motorist: Coverage for inadequately insured drivers.

- Underinsured Motorist Coverage: Protects against underinsured drivers.

- Underlying Insurance: Primary insurance before excess coverage.

- Underlying Policy: Basic policy beneath excess insurance.

- Underwriter’s Report: Assessment for insurance underwriting.

- Underwriting: Evaluating and pricing insurance risk.

- Underwriting Guidelines: Criteria for insurance risk assessment.

- Underwriting Manual: Reference for underwriting policies.

- Underwriting Profit: Profit from underwriting activities.

- Unearned Premium: Premium for future coverage.

- Uninsured Motorist Coverage: Covers incidents with uninsured drivers.

V-W

- Vacancy Clause: Terms for insuring vacant property.

- Vacancy Permit: Authorization for insuring vacant property.

- Valuable Papers and Records Coverage: Insurance for important documents.

- Value Reporting Form: Document for reporting property values.

- Valued Policy: Policy with agreed-upon property value.

- Vandalism and Malicious Mischief Insurance: Covers property damage from vandalism.

- Voluntary Compensation Insurance: Optional worker’s compensation coverage.

- Waiver of Premium: Exemption from paying insurance premium.

- Waiver of Subrogation: Relinquishes insurer’s right to recovery.

- Windstorm Insurance: Insurance for wind-related damages.

- Workers’ Compensation: Coverage for injured employees.

- Workers’ Compensation Exclusion: Excludes worker’s comp from policy.

- Wrap-Up Insurance: Comprehensive policy for large projects.