When it comes to navigating the world of life insurance, understanding the terminology is key to making informed decisions. Whether you’re a first-time buyer or a seasoned policyholder, the complex language used in life insurance contracts, policies, and discussions can be overwhelming. That’s why we’ve created this comprehensive guide to help you decode the jargon and demystify the terminology.

In this blog post, we’ll provide clear and concise definitions for over 190 life insurance terms and concepts, making it easier for you to grasp the intricacies of this essential financial tool. To make your life even simpler, we’re also offering a PDF download of this guide for your reference. Whether you’re looking to purchase a new policy, understand your existing one, or explore the various riders and options available, this guide has you covered.

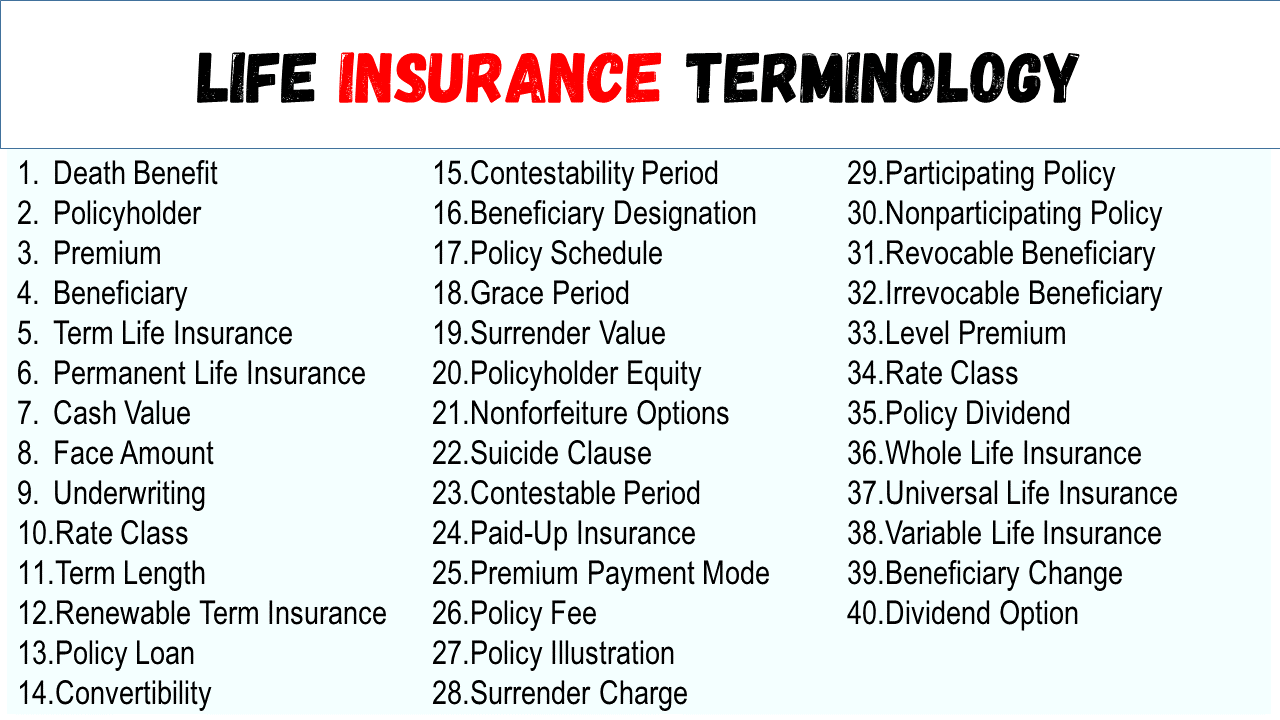

Let’s kick things off by delving into some fundamental life insurance terminology, shedding light on the terms you’re likely to encounter during your insurance journey. Whether you’re curious about terms like “Death Benefit,” “Premium,” or “Beneficiary,” we’ve got you covered. So, let’s dive in and start unraveling the world of life insurance!

Also Read: 50 Words Associated With Insurance

Download Life Insurance Terminology Pdf, Here.

Life Insurance Terminology

#:

- 1031 Exchange: A tax-deferred exchange that allows the owner of certain investment properties to sell them and reinvest the proceeds into similar properties, deferring capital gains tax.

- 1035 Exchange: A provision in the tax code that allows the tax-free exchange of one life insurance policy or annuity for another, typically to better meet the policyholder’s financial goals.

A:

- Accelerated Death Benefit: A feature in a life insurance policy that allows the policyholder to receive a portion of the death benefit while still alive if they are diagnosed with a terminal illness.

- Accelerated Death Benefit Rider: An optional addition to a life insurance policy that provides an accelerated death benefit in case of a terminal illness, helping policyholders cover medical expenses or other financial needs.

- Accidental Death Benefit Rider: A policy rider that provides an additional death benefit if the insured person dies due to an accident, in addition to the regular death benefit.

- Adjustable Death Benefit: A feature of certain life insurance policies that allows the policyholder to increase or decrease the death benefit amount, often to adapt to changing financial circumstances.

- Adjustable Life Insurance: A type of life insurance policy that offers flexibility in premium payments, death benefit amounts, and sometimes investment options, allowing policyholders to adjust their coverage as needed.

- Administrative Charge: A fee charged by the insurance company to cover administrative expenses related to maintaining and servicing a life insurance policy.

- Annual Renewable Term Life Insurance: A type of term life insurance where the premium and death benefit are renewed on an annual basis, with the premium increasing each year as the insured person’s age increases.

- Attending Physician Statement (APS): A report from a healthcare provider detailing an applicant’s medical history, conditions, and treatments, which is often used by insurance companies during the underwriting process.

- Automatic Premium Loan: A provision in some life insurance policies that allows the insurer to use the policy’s cash value to automatically pay overdue premiums, preventing the policy from lapsing.

- Aviation Clause: A provision in a life insurance policy that specifies the terms and conditions under which coverage is provided for individuals engaged in aviation-related activities, as they may face higher risks.

B:

- Beneficiary: The person or entity designated to receive the death benefit from a life insurance policy upon the insured’s death.

- Beneficiary Change: The process of altering the previously designated beneficiary on a life insurance policy, typically done through a formal request to the insurance company.

- Beneficiary Designation: The act of selecting and officially naming the individual(s) or entity to receive the death benefit from a life insurance policy.

- Blood Test: A medical examination involving the analysis of a blood sample to assess an applicant’s health and risk factors during the underwriting process.

- Business Continuation Insurance: Life insurance designed to facilitate the transfer of a deceased business owner’s interest to surviving partners or co-owners, ensuring the business’s continuity.

- Buy-Sell Agreement: A legally binding agreement between business owners that outlines the terms and conditions for buying or selling a deceased owner’s share of the business, often funded by life insurance.

C:

- Cash Accumulation: The growth of funds within a permanent life insurance policy’s cash value component over time, which can be accessed by the policyholder.

- Cash Surrender Value: The amount of money that a policyholder can receive if they surrender (terminate) a cash value life insurance policy before its maturity date, subject to surrender charges and taxes.

- Cash Value: The portion of a permanent life insurance policy that accumulates value over time and can be accessed by the policyholder through withdrawals, loans, or surrender.

- Cash Value Life Insurance: A type of life insurance that includes a cash value component, such as whole life or universal life insurance, in addition to the death benefit.

- Child Rider: An optional policy rider that provides life insurance coverage for a child of the policyholder, often with a smaller face amount and lower cost.

- Contestability Period: A limited timeframe (usually the first two years of a policy) during which an insurance company can contest a policy’s validity and deny a claim based on misrepresentation or concealment of material facts by the policyholder.

- Contingent Beneficiary: A secondary beneficiary named to receive the death benefit if the primary beneficiary predeceases the insured.

- Contingent Owner: An individual or entity designated to assume ownership and control of a life insurance policy if the original policyholder becomes incapacitated or dies.

- Conversion Option: A feature in term life insurance policies that allows the policyholder to convert their policy into a permanent life insurance policy without the need for a medical examination, typically within a specified timeframe.

- Convertibility Rider: A policy rider that grants the policyholder the option to convert a term life insurance policy into a permanent life insurance policy.

- Convertible Term Life Insurance: Term life insurance that includes the option to convert the policy into a permanent life insurance policy without a medical exam.

- Cost of Insurance Charge: The fee deducted from the cash value of a permanent life insurance policy to cover the insurance company’s cost of providing coverage.

- Critical Illness Rider: An optional rider that provides a lump-sum benefit if the insured is diagnosed with a specified critical illness, such as cancer, heart attack, or stroke, in addition to the regular death benefit.

- Cross-Purchase Plan: A buy-sell agreement in which individual business owners agree to purchase the ownership interests of deceased co-owners using life insurance policies on each other’s lives.

- Crummey Trust: A type of irrevocable trust that allows beneficiaries to have limited withdrawal rights for gifts made into the trust, often used for estate planning and to fund life insurance premiums.

D:

- Death Benefit: The sum of money paid to the beneficiary upon the death of the insured person, as specified in the life insurance policy.

- Death Benefit Option: The choice made by the policyholder regarding how the death benefit will be paid out to the beneficiary, such as a lump sum, annuity, or installment payments.

- Death Benefit Options: The various ways in which the death benefit can be distributed to the beneficiary, as specified in the life insurance policy.

- Death Claim: A formal request made to the insurance company by the beneficiary or their representative to receive the death benefit after the insured person’s passing.

- Death Protection: The primary purpose of life insurance, which is to provide financial protection to the policyholder’s beneficiaries in the event of the policyholder’s death.

- Declined: The outcome of an underwriting decision where an applicant is not approved for a life insurance policy due to high risk or other disqualifying factors.

- Decreasing Term Life Insurance: A type of term life insurance where the death benefit gradually decreases over the policy’s term, often used to cover specific debts like mortgages.

- Disability Income Rider: An optional rider that provides a regular income stream to the policyholder if they become disabled and are unable to work, typically in addition to the regular death benefit.

- Dividend Accumulation Option: A choice offered to policyholders of participating whole life insurance policies, allowing them to reinvest policy dividends to accumulate additional cash value.

- Dividend Income Option: A policyholder’s choice to receive policy dividends as regular income payments, rather than reinvesting them or using them to offset premium payments.

- Dividend Option: The various ways in which policyholders can choose to receive or use policy dividends, such as cash, reduced premiums, paid-up additions, or additional coverage.

E:

- Entity Purchase Plan: A buy-sell agreement in which the business entity itself agrees to purchase the ownership interest of a deceased owner using life insurance policies on the owners’ lives.

- Estate Planning: The process of arranging one’s financial affairs and assets to ensure efficient and tax-effective transfer to heirs or beneficiaries upon the individual’s death.

- Estate Tax: A tax imposed on the value of an individual’s estate at the time of their death, which may be levied by federal and/or state governments.

- Exclusion: A condition or circumstance specified in the life insurance policy that limits or excludes coverage under certain circumstances, such as a suicide exclusion within the first two years of the policy.

- Expense Charge: A fee charged by the insurance company to cover the administrative and operational costs of managing a life insurance policy.

- Extended Term Insurance: A nonforfeiture option in a whole life insurance policy that allows the policyholder to use the policy’s cash value to purchase a term life insurance policy with the same death benefit, providing coverage for a limited period without additional premiums.

F:

- Face Amount: The initial death benefit amount specified in a life insurance policy.

- Family History: Information about an individual’s family members’ medical and health history, which may be considered during the underwriting process to assess the applicant’s risk.

- Final Expense Insurance: A type of life insurance designed to cover the costs associated with a policyholder’s funeral, burial, and other end-of-life expenses.

- Flexible Death Benefit: A feature of certain life insurance policies that allows the policyholder to adjust the death benefit amount to meet changing financial needs, often subject to underwriting approval.

- Flexible Premium: The ability of the policyholder to adjust the amount and frequency of premium payments within certain limits in flexible premium life insurance policies.

- Flexible Premium Payment: The option to choose different premium payment amounts or frequencies within certain limits in flexible premium life insurance policies.

- Flexible Premium Universal Life Insurance: A type of universal life insurance policy that allows policyholders to adjust both the death benefit and premium payments based on their changing financial circumstances.

G:

- Gift Tax: A tax imposed on the transfer of assets or property as a gift, which may apply to large gifts given during an individual’s lifetime.

- Grace Period: A specified period (usually 30 days) after a premium due date during which the policy remains in force, even if the premium has not been paid, giving the policyholder time to make the payment without policy lapse.

- Graded Premium Whole Life Insurance: A type of whole life insurance policy in which the premium starts lower than a traditional whole life policy but increases gradually over time.

- Guaranteed Cash Value: The minimum amount of cash value that a permanent life insurance policy will accumulate over time, as guaranteed by the insurance company.

- Guaranteed Insurability Rider: A policy rider that allows the policyholder to purchase additional coverage at specified future dates without the need for a medical examination or underwriting, often used to increase coverage as income rises.

- Guaranteed Issue: A type of life insurance policy that is typically issued without requiring a medical examination or underwriting, often available to individuals with certain health conditions.

- Guaranteed Issue Life Insurance: A type of life insurance policy that is guaranteed to be issued to eligible applicants without medical underwriting, typically with limited coverage amounts.

- Guaranteed Minimum Death Benefit: The minimum death benefit amount guaranteed in certain permanent life insurance policies, regardless of cash value fluctuations.

- Guaranteed Minimum Death Benefit Rider: A policy rider that guarantees a minimum death benefit amount in addition to any cash value in a permanent life insurance policy.

- Guaranteed Renewability: A feature of some term life insurance policies that allows the policyholder to renew the policy at the end of the term without the need for a medical examination or underwriting, typically at a higher premium rate.

H:

- Hazardous Hobby: An activity or pastime that is considered risky or dangerous, which may affect an applicant’s eligibility for life insurance and premium rates.

- Hazardous Occupation: A job or profession that involves high levels of risk or danger, potentially impacting an applicant’s life insurance eligibility and premium rates.

I:

- Incontestability Clause: A provision in a life insurance policy that prevents the insurance company from contesting the validity of the policy or denying a claim after a specified period (usually two years) from the policy’s issuance.

- Increasing Term Life Insurance: A type of term life insurance where the death benefit increases over time, typically to keep pace with inflation or changing financial needs.

- Indexed Universal Life Insurance: A type of universal life insurance policy that allows the policyholder to allocate cash value to an account linked to a stock market index, potentially earning higher returns.

- Insured: The individual whose life is covered by a life insurance policy, and whose death triggers the payment of the death benefit.

- Investment Risk: The risk associated with the potential loss of value or return on investments made within certain types of life insurance policies, such as variable life insurance.

- Irrevocable Beneficiary: A beneficiary designation that cannot be changed or revoked by the policyholder without the beneficiary’s consent.

- Irrevocable Life Insurance Trust (ILIT): A trust established to hold a life insurance policy, with the beneficiary designation set as irrevocable, often used for estate planning purposes.

J:

- Joint Life Insurance: A single life insurance policy that covers two individuals, with the death benefit payable upon the first insured person’s passing.

K:

- Key Person Insurance: Life insurance purchased by a business to protect against financial losses that may result from the death or disability of a key employee or owner.

L:

- Lapse: The termination of a life insurance policy due to the non-payment of premiums, resulting in the loss of coverage.

- Level Premium: A fixed premium amount that remains consistent throughout the term of a life insurance policy, typically associated with whole life and universal life insurance policies.

- Level Term Life Insurance: A type of term life insurance where the premium and death benefit remain constant throughout the policy’s term.

- Life Insurance: A financial contract that provides a death benefit to designated beneficiaries upon the death of the insured person, in exchange for regular premium payments.

- Life Settlement: The sale of a life insurance policy by the policyholder to a third party in exchange for a lump-sum payment, typically at a value higher than the policy’s cash surrender value.

- Limited Payment Life Insurance: A type of whole life insurance policy that allows the policyholder to pay premiums for a limited number of years (e.g., 10, 15, or 20 years) while maintaining coverage for life.

- Loan Interest Rate: The interest rate charged by the insurance company when policyholders borrow money against the cash value of their life insurance policy through policy loans.

- Long-Term Care Rider: An optional rider that provides coverage for long-term care expenses, such as nursing home care or home healthcare, in addition to the regular death benefit.

M:

- Market Value Adjustment: A provision in some life insurance policies with investment components that adjusts the policy’s surrender value based on changes in the market value of underlying investments.

- Maturity Benefit: The amount paid to the policyholder when a life insurance policy reaches its maturity date in the case of certain types of policies, such as endowment or whole life insurance.

- Maturity Date: The date on which a life insurance policy matures, typically when the policyholder reaches a specified age or after a predetermined number of years.

- Medical Exam: A thorough physical examination, including medical history and various tests, conducted by a healthcare professional to assess an applicant’s health and determine their eligibility for life insurance.

- Medical Information Bureau (MIB): A centralized database that collects and shares medical and underwriting information among life insurance companies to help assess an applicant’s risk accurately.

- Medical Records: A comprehensive collection of an individual’s medical history, including diagnoses, treatments, and test results, used by insurance companies during underwriting.

- Modified Endowment Contract (MEC): A life insurance policy that has been funded with premiums in excess of federal tax law limits, potentially subjecting it to adverse tax treatment.

- Mortality Charge: The cost of life insurance coverage included in the premium, based on the risk of the insured person passing away during the policy term.

N:

- No-Lapse Guarantee Universal Life Insurance: A type of universal life insurance policy that includes a guarantee that the policy will remain in force as long as certain premium requirements are met, even if the cash value drops to zero.

- Nonforfeiture Options: Choices available to policyholders of permanent life insurance policies when they surrender or allow their policies to lapse, including options like receiving the cash surrender value, converting to paid-up insurance, or extending coverage with extended term insurance.

- Non-Guaranteed Issue: A type of life insurance policy that requires some level of underwriting or medical evaluation before approval, but may still be more lenient than traditional underwriting.

- Non-Guaranteed Issue Life Insurance: A type of life insurance policy that is typically issued without requiring a medical examination or extensive underwriting, but may still have some medical questions or limitations.

- Non-MEC Policy: A life insurance policy that does not meet the IRS criteria for being classified as a Modified Endowment Contract (MEC), allowing for more favorable tax treatment.

- Nonparticipating Policy: A life insurance policy that does not participate in the distribution of dividends from the insurance company’s surplus, and policyholders do not have a say in the company’s operations.

O:

- One-Year Term Dividend Option: A dividend option that allows policyholders to use their dividends to purchase additional one-year term life insurance coverage.

P:

- Paid-Up Additions: Additional coverage purchased with dividends in a participating whole life insurance policy, increasing both the death benefit and cash value.

- Paid-Up Insurance: A policy status in which the policyholder has paid enough premiums to maintain the coverage without the need for further premium payments.

- Paramedical Exam: A medical examination conducted by a paramedic or nurse to gather health-related information required for underwriting life insurance policies.

- Participating Policy: A type of life insurance policy that allows policyholders to participate in the distribution of dividends from the insurance company’s surplus, potentially increasing the policy’s cash value and death benefit.

- Per Capita: A beneficiary designation that distributes the policy’s death benefit equally among all named beneficiaries.

- Per Stirpes: A beneficiary designation that distributes the policy’s death benefit among the descendants of a deceased beneficiary if the original beneficiary is no longer living.

- Permanent Life Insurance: A category of life insurance that provides coverage for the insured’s entire lifetime and typically includes a cash value component, such as whole life, universal life, or variable universal life insurance.

- Personal History: Information about an individual’s personal background, such as lifestyle habits, hobbies, and travel history, which may be considered during the underwriting process to assess the applicant’s risk.

- Policy: A legal contract between the insurance company and the policyholder that outlines the terms, conditions, and provisions of the life insurance coverage.

- Policy Charges: Various fees and charges associated with the administration, maintenance, and provision of life insurance coverage within a policy.

- Policy Dividend: A share of the insurance company’s surplus profits, distributed to policyholders of participating policies as a form of return on their investment.

- Policy Expenses: The costs incurred by the insurance company for administering and servicing a life insurance policy, including administrative expenses, commissions, and underwriting costs.

- Policy Fee: A periodic fee charged by the insurance company to cover administrative costs associated with maintaining the policy.

- Policy Illustration: A document provided to the policyholder that illustrates how the life insurance policy is expected to perform over time, including projections of cash values and death benefits.

- Policy Lapse: The termination of a life insurance policy due to non-payment of premiums, resulting in the loss of coverage.

- Policy Loan: A loan taken by the policyholder from the cash value of a permanent life insurance policy, using the policy’s cash value as collateral.

- Policy Loan Interest: The interest charged by the insurance company on a policy loan taken by the policyholder against the cash value of a permanent life insurance policy.

- Policy Performance: The assessment of how a life insurance policy is performing in terms of cash value growth, death benefit, and other relevant factors.

- Policy Premium: The amount paid by the policyholder to the insurance company to maintain coverage under a life insurance policy.

- Policy Schedule: A document that provides details about the life insurance policy, including the policy’s terms, conditions, premium payment schedule, and coverage amounts.

- Policy Term: The duration for which a life insurance policy provides coverage, whether it’s a fixed term in the case of term life insurance or the entire lifetime in the case of permanent life insurance.

- Policyholder: The individual or entity that owns a life insurance policy and is responsible for paying premiums and making decisions related to the policy.

- Policyholder Equity: The policyholder’s interest in the cash value of a permanent life insurance policy, which represents the policy’s accumulated savings and can be accessed through withdrawals or loans.

- Policyowner Age: The age of the policyholder, which can impact premium rates, eligibility for certain riders, and other aspects of the life insurance policy.

- Preferred: A rating class for life insurance applicants who are in excellent health and have a low risk of mortality, typically eligible for lower premium rates.

- Preferred Plus: An even higher rating class for life insurance applicants who are in exceptional health and have an extremely low risk of mortality, often eligible for the lowest premium rates.

- Premium: The payment made by the policyholder to the insurance company to maintain life insurance coverage.

- Premium Allocation: The distribution of premium payments between the cost of insurance, administrative expenses, and the cash value component in permanent life insurance policies.

- Premium Financing: A strategy in which a third-party lender provides funds to pay life insurance premiums, often used by high-net-worth individuals for estate planning.

- Premium Flexibility: The ability of the policyholder to adjust the premium payment amount or frequency within certain limits, typically associated with universal life insurance policies.

- Premium Offset: A feature in some permanent life insurance policies where the policy’s cash value is used to offset premium payments, potentially allowing the policyholder to pay fewer premiums out of pocket.

- Premium Payment Flexibility: The option for policyholders to choose different premium payment amounts or frequencies within certain limits, often available in flexible premium life insurance policies.

- Premium Payment Mode: The frequency at which premium payments are made, such as monthly, quarterly, semi-annually, or annually.

- Primary Beneficiary: The first-named beneficiary in a life insurance policy, who is entitled to receive the death benefit if eligible and alive at the time of the insured’s death.

- Prospectus: A document provided to potential buyers of variable life insurance or annuity products that discloses information about the investment options, risks, and performance of the underlying investments.

R:

- Rate Class: A classification assigned to an applicant by the insurance company based on their risk profile, which determines the premium rate for the life insurance policy.

- Reduced Paid-Up Insurance: A nonforfeiture option in a whole life insurance policy that allows the policyholder to stop paying premiums and convert the policy into a paid-up policy with a reduced death benefit.

- Reinsurance: The practice of an insurance company transferring a portion of its risk to another insurance company, often used to manage large or catastrophic risks.

- Renewable Term Insurance: A type of term life insurance that allows the policyholder to renew the coverage at the end of the term without the need for a medical examination, typically at a higher premium rate.

- Renewable Term Life Insurance: See “Renewable Term Insurance.”

- Return of Premium Rider: An optional rider that provides a refund of premiums paid if the insured person survives the policy’s term, typically added to term life insurance policies.

- Return of Premium Term Life Insurance: A type of term life insurance that provides a refund of premiums paid if the insured person survives the policy’s term.

- Revocable Beneficiary: A beneficiary designation that can be changed or revoked by the policyholder without the beneficiary’s consent.

- Rider: An optional provision or attachment to a life insurance policy that modifies or adds specific benefits, coverage, or conditions to the base policy.

- Risk Assessment: The process of evaluating an applicant’s health, lifestyle, and other factors to determine their eligibility for life insurance and the appropriate premium rate.

S:

- Sales Load: A fee or commission charged by the insurance company or agent for selling a life insurance policy, often deducted from the policy’s premium payments.

- Senior Life Settlement: The sale of a life insurance policy by a senior policyholder to a third party for a lump-sum payment, typically used to access funds for retirement or medical expenses.

- Separate Account: A segregated investment account within a variable life insurance policy that holds the policy’s underlying investments, allowing policyholders to choose from a range of investment options.

- Single Premium Life Insurance: A type of permanent life insurance policy that is funded by a single, upfront premium payment, providing lifetime coverage and cash value growth.

- Spouse Rider: An optional rider that provides life insurance coverage on the policyholder’s spouse, often included in a single policy.

- Standard: A rating class for life insurance applicants who are considered average in terms of health and risk, typically eligible for standard premium rates.

- Subaccount: A sub-portfolio within a separate account in a variable life insurance policy, representing a specific investment option that policyholders can choose.

- Substandard: A rating class for life insurance applicants who are considered higher risk due to health conditions, lifestyle factors, or other issues, typically associated with higher premium rates.

- Suicide Clause: A provision in a life insurance policy that limits or excludes coverage for death by suicide within a specified period after the policy’s issuance or reinstatement.

- Surrender Charge: A fee imposed by the insurance company if the policyholder surrenders or terminates a permanent life insurance policy and accesses the cash value before a certain period, typically several years, has passed.

- Surrender Period: The specified time period during which surrender charges apply if the policyholder terminates a permanent life insurance policy and accesses the cash value.

- Surrender Value: The amount that the policyholder receives if they surrender or terminate a permanent life insurance policy and access the cash value, typically after accounting for surrender charges.

- Survivorship Life Insurance: A type of permanent life insurance policy that covers two insured individuals, with the death benefit payable upon the death of the second insured person, often used for estate planning.

T:

- Target Premium: The premium amount that, when paid regularly, is expected to keep a universal life insurance policy in force to the insured’s intended age.

- Term Conversion: The process of converting a term life insurance policy into a permanent life insurance policy, typically without the need for a medical examination, within a specified timeframe.

- Term Length: The duration for which a term life insurance policy provides coverage, which can vary from a few years to several decades.

- Term Life Insurance: A type of life insurance that provides coverage for a specified period (term), often at a lower premium than permanent life insurance.

- Term Premiums: The premium payments for a term life insurance policy, which are typically lower than those for permanent life insurance.

- Term Rider: An optional rider that provides additional term life insurance coverage, typically used to supplement the base policy’s death benefit.

- Trustee: An individual or entity appointed to manage and oversee the assets and terms of a trust, which may include life insurance policies.

- Trust-Owned Life Insurance (TOLI): Life insurance policies held within a trust to achieve specific estate planning goals, such as providing liquidity for estate taxes.

U:

- Underwriter: A trained professional responsible for assessing applicants’ risk profiles, determining their insurability, and setting premium rates for life insurance policies.

- Underwriting: The process of evaluating an applicant’s risk and determining their eligibility for life insurance coverage, including rate class assignment and premium rate calculation.

- Underwriting Age: The age at which an applicant is classified for underwriting purposes, which may differ from the applicant’s actual age based on policy guidelines.

- Universal Life Insurance: A type of permanent life insurance that offers flexibility in premium payments, death benefits, and cash value growth, allowing policyholders to adjust their coverage over time.

- Urine Test: A medical examination involving the analysis of a urine sample to assess an applicant’s health and risk factors during the underwriting process.

V:

- Variable Death Benefit: A death benefit amount in a variable life insurance policy that may fluctuate based on the performance of underlying investments in the policy’s separate accounts.

- Variable Investment Options: Investment choices are offered within a variable life insurance policy that allows policyholders to allocate their cash value among various investment funds.

- Variable Life Insurance: A type of permanent life insurance that allows policyholders to invest the cash value component in various investment options, with the death benefit and cash value subject to market fluctuations.

- Variable Universal Life Insurance: A type of universal life insurance that combines features of both variable life insurance and universal life insurance, allowing policyholders to invest the cash value in variable investment options while maintaining premium flexibility.

- Viatical Settlement: The sale of a life insurance policy by a terminally ill policyholder to a third party in exchange for a lump-sum payment, providing financial support for medical expenses or end-of life care.